Central research topics

- Analysis of the purchase intention of private investors and corporate enterprises

- Analysis and simulation of the market development of technologies (e.g. renewable energies, electric vehicles or Power2Gas plants)

- Impact assessment of the policy framework on the market development

Background of model application

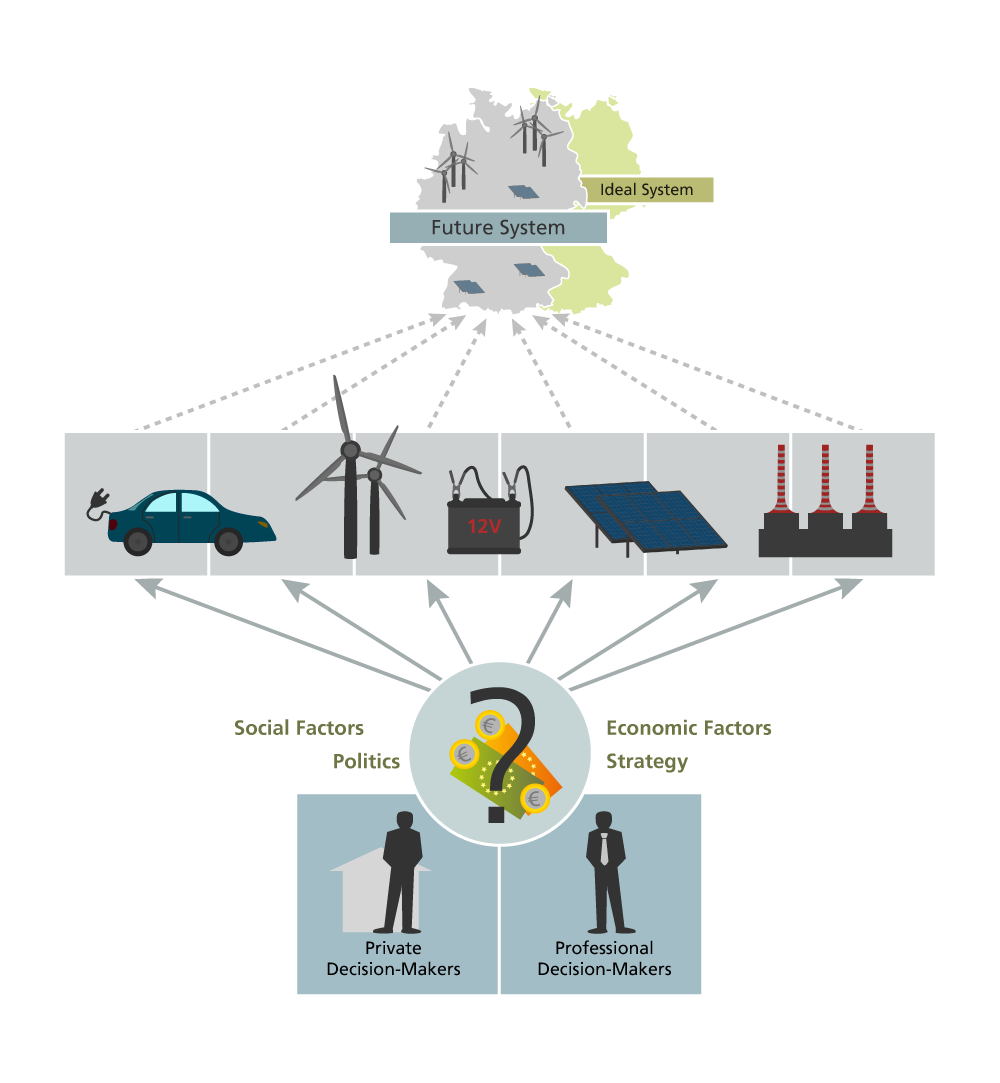

In the field of energy system analysis, a number of models are providing answers to the question of how the energy system could look like in the future if the German government's CO2-emission reduction targets are met. It implies that the target, e.g. the CO2-reduction, is an input condition for the model. In contrast, the InvE2St model aims at exploratively simulating (based on the current technology stock), how energy system relevant technologies penetrate the market.

The model shows whether the target corridors of individual technologies, which result from the modelling of future energy systems, can be achieved under the given framework conditions or deviate from these corridors. The respective framework conditions can be varied in order to draw conclusions about their influence on technology diffusion and to examine which framework conditions have to be modified in which manner in order to reach a certain target.

The modelling is based on the most important factors and their weighting in relation to each other, which influence an investment decision. Each technology is initially divided into two groups of actors: On the one hand, there are private actors who make a personal investment decision, such as an investment in a solar-powered battery system or in a private electric vehicle. For this purpose, methods from the social sciences and psychology are used to determine the factors influencing a purchase intention. The other group are corporate actors who make investments as part of their business plan in order to generate profits. Therefore, methods from the social sciences are applied to describe the investment decision processes and to depict them in a decision model.

With the knowledge about decision-influencing factors and their possible future development it can be simulated, how the technology penetrates the market under the assumed framework developments and whether adjustments of the framework conditions are necessary to reach a given goal.